by Ileana Bravo | Jul 26, 2018 | blog, LinkedIn

Business owners have had their CPAs and attorneys on speed dial this year trying to figure out the full impact and consequences of last year’s tax changes on their 2018 Income taxes. While clearly some businesses will benefit, realizing lower taxes from pass-through...

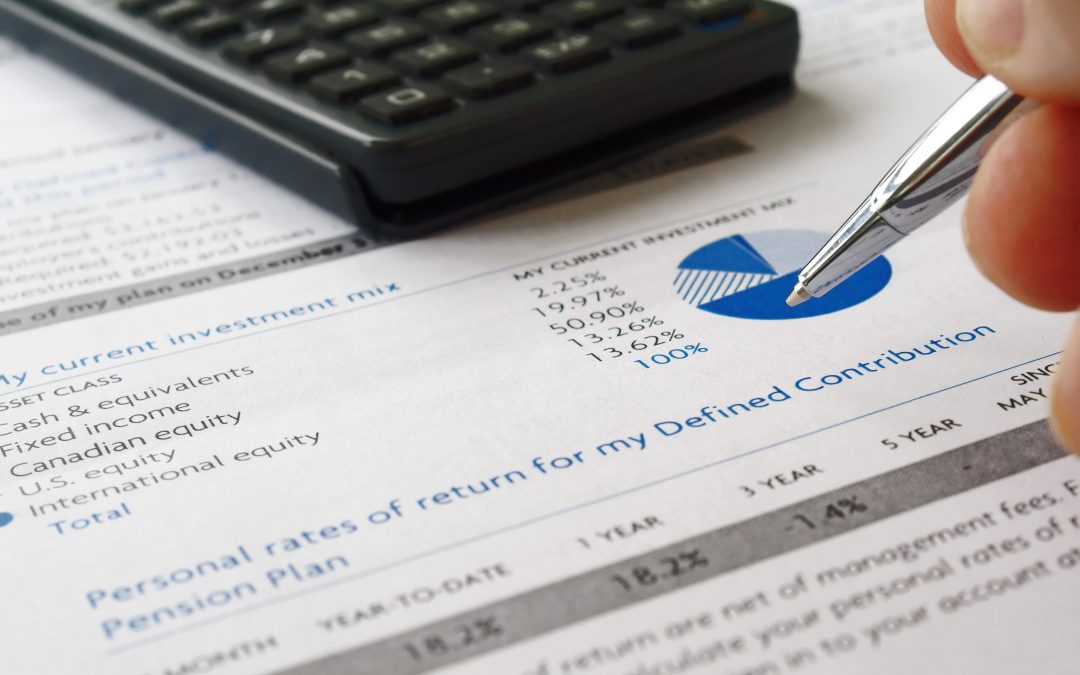

by Gene Gordon | Jun 18, 2018 | blog

You made the right moves to realize tax savings by creating tax-sheltered retirement plans and implementing a 401(k), Profit Sharing Plan, or SEP. Those with bigger needs might have used a more sophisticated strategy to help clinch bigger deductions by stacking a Cash...

by Gene Gordon | Apr 16, 2018 | blog

At one time genetic testing was strictly used in medical settings, as a way to predict if someone was at risk of developing certain medical conditions. The results are not foolproof but can be a strong indicator of whether a person could develop diseases such as...

by Gene Gordon | Apr 9, 2018 | blog

As our money managers and CPAs put the finishing touches on our 2017 tax returns, we are already pivoting and have the 2018 tax situation on our minds. What surprises will next year bring with the looming new Tax Cuts and Jobs Act? What will the near future spell in...

by Gene Gordon | Mar 12, 2018 | blog, LinkedIn, PensionQuote Blog

Springing forward into daylight savings time also ushers in tax season and the fear that we may face a big tax bill in April. Another reality will set in soon due to the new tax bill, which will spell significant changes as to what will be tax deductible. Several...

by Ileana Bravo | Nov 20, 2017 | blog, Members Area

Business owners who are hoping for large tax deductions for this year are running out of time to lock in those savings if you haven’t made a move yet on the cusp of the holidays. Surely you have a lot for which to be thankful but you could be showing your...