Springing forward into daylight savings time also ushers in tax season and the fear that we may face a big tax bill in April. Another reality will set in soon due to the new tax bill, which will spell significant changes as to what will be tax deductible. Several valuable tax deductions will cease to exist after the 2017 filing… key line items you will no longer be able to deduct on our tax forms after this year.

1) State and Local Tax Deductions. Previous rules allowed for the deduction of the full amount of their state income taxes or their state and local sales taxes as well as property taxes. However, the new tax law lumps all three together and caps them at $10,000. For property owners with high taxes, not being able to fully write them off could result in a higher tax bill.

2) Moving Expenses. This deduction allows you to write off “reasonable moving expenses” incurred if you move more than 50 miles and relocated for work. If you moved in 2017, you certainly lucked out, as this deduction was has been suspended from 2018 through 2025.

3) Mortgage Interest Deduction. For mortgages originated before December 15, 2017, you can deduct interest paid on home loan balances up to $1 million. For newer mortgages, the cap drops to $750,000, which will affect home buyers in high priced neighborhoods. Also, former rules allowed for the deduction of interest on home equity loans or lines of credit. The deduction will no longer apply starting in 2018.

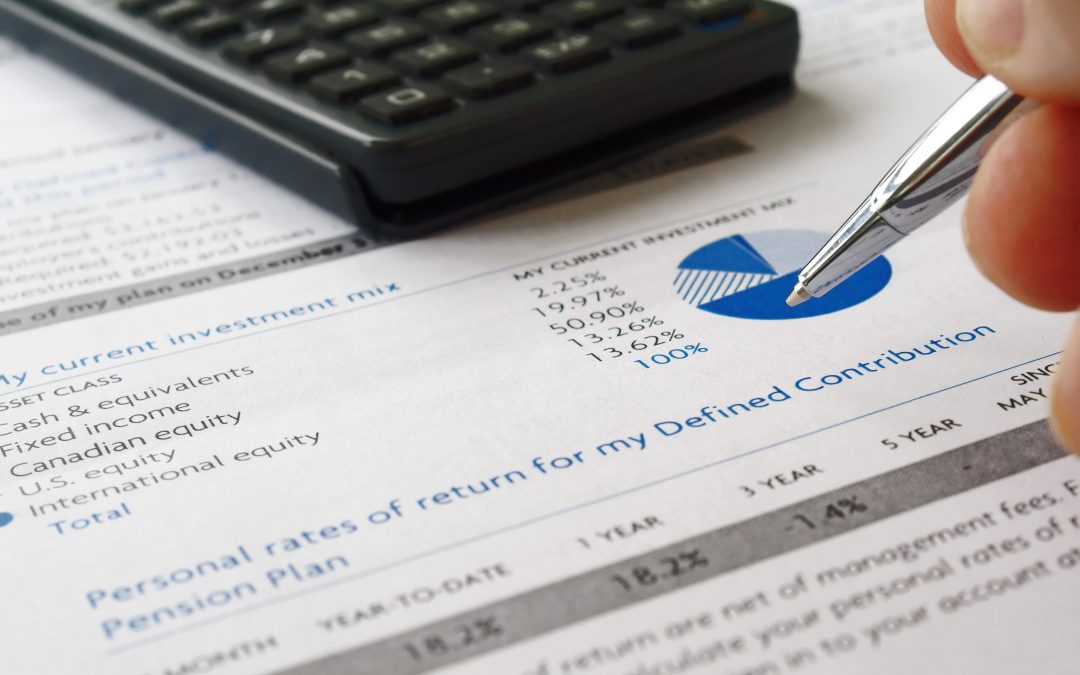

So what should your CPA or accounting professional do to handle these deduction exclusions now? Their clients are demanding prudent tax deduction strategies in light of the new tax laws. What we have found is that many CPAs with business owner clients are turning to tried and true custom Split Funded Cash Balance Defined Benefit Plans— plans that may provide multi-hundred thousand deductions per year. Employing the split funded strategy, clients enjoy a diverse, yet safe asset mix, whether they incorporate whole life insurance or indexed universal life in the plan design. And when properly structured, the plans should leverage in favor of the business owners and provide exit strategies including a tax-free income stream. Another question facing CPAs relates to the 20% deduction on pass-through business income. Because doctors, lawyers, financial advisers, and other professions are deemed to be “service” businesses, they’re ineligible for the pass-through deduction if their overall income exceeds the limit of $315,000 for a married couple ($157,500 for a single taxpayer). So naturally, CPAs will be seeking ways to reduce certain clients’ income to these thresholds in order to take advantage of the 20% write off. And the easiest and most obvious strategy is to implement a qualified plan. Using a 401(k)/profit sharing plan combination a business owner client may deduct $55,000 in 2018, $61,000 for those ages 50 and over. Just think about that – the client is deducting the $55,000 and is then deducting an additional 20% – it’s truly a “double dip” deduction. But what about clients who need even greater deduction to bring their income down to the threshold? That’s where the cash balance strategy may be the perfect fit. But unlike 401(k)/profit sharing plans, clients must be mindful that cash balance plans are designed to be funded for several years. And let’s not forget that the best time to implement a robust qualified plan may be right now, early in the year, if the client is looking for a strategy to reduce their quarterly tax estimates. So while CPAs are now trying to grab all the tax deductions they can for 2017, they are running projections for 2018 and considering the many options to bring to the table. Listen carefully to your accountant’s advice on these strategies that can significantly reduce your tax bill moving forward.

About Us

We are pioneers in retirement planning, featuring tax-advantaged defined benefit pension plans as exit strategies for high net worth clients. We partner with top industry Advisers to bring their clients preferred solutions to achieve large income tax deductions.

Location

Coral Gables, FL

Call Us

Phone: 1-800-717-4723

Working Hours

Monday-Friday: 9:00am – 5:00pm